“They laughed at Columbus and they laughed at the Wright brothers. But they also laughed at Bozo the Clown.” - Carl Sagan

“We've learned and struggled for a few years here figuring out how to make a decent phone. PC guys are not going to just figure this out. They're not going to just walk in.” - Ed Colligan, CEO of Palm, 2006, on rumours of an Apple phone

Kodak Lessons From a Tragic Business Failure

In 1975, Steve Sasson a Kodak engineer invented the world's first digital camera, a prototype the size of a toaster that captured black-and-white images at a unbelievably low resolution of just .01 megapixels (by comparison, there’s now smartphone with in excess of 50-megapixel resolution available).

Because the first digital camera was filmless, Kodak management wanted Sasson to keep quiet about his invention rather than embrace it as the future of photography.

And then there was Nokia

When Nokia people looked at the first iPhone, they saw a not-great phone with some cool features that they were going to build too, being produced at a small fraction of the volumes they were selling. They shrugged. “No 3G, and just look at the camera!”

When many car company people look at a Tesla, they see a pretty average featured car with average finish and some cool features that they’re planning to build too, coming off the production lines at smaller volumes than they’re selling. “Look at the fit and finish, and the panel gaps, and the tent! (one of Tesla's new production lines is in a tent)” They say.

The Nokia people were absolutely mistaken and wrong. Could the car people be wrong too? Tesla is ‘the new iPhone’ if that's true what does it really mean?

This is partly a question about Tesla, but it’s more interesting as a way to think about what happens when ‘software eats the world’ or software type innovation eats the world; that's when tech moves into new industries and that tech has the ability to make many iterative changes at the micro or nano scale.

How do we decide or reckon with something being disruptive? If it is disruptive, who or what is getting disrupted? Does that disruption mean that one company is the winner in this brave new world? Which company will win? Will the disrupter actually get disrupted itself by a new commodity priced version of its technology by the older players, killing off the disruptor shortly after it introduces its revolutionary new technology.

The idea of ‘disruption’ is that a new concept changes the basis of competition in an industry. At the beginning, either the new thing itself or the companies bringing it (or both) tend to be bad at the things the incumbents value (older metrics of success), and get laughed at, but if they learn those things as well the laughter soon stops.

Conversely, the incumbents either dismiss the new thing as pointless or presume they’ll easily be able to add it (or both), but they’re often wrong. Apple brought software and learnt phones, whereas Nokia had great phones but could not learn software.

However, not every new technology or idea is disruptive. Some things do not change the basis of competition enough, and for some things the incumbents are able to learn and absorb the new concept instead (these are not quite the same thing). Clay Christensen calls this ‘sustaining innovation’ as opposed to ‘disruptive innovation’ as is sustains the status quo.

However any new technology is probably disruptive to someone, at some part of the value chain. The iPhone disrupted the handset business, but has not disrupted the cellular network operators at all, though many people were convinced that it would. For all that’s changed, the same companies still have the same business model and the same customers that they did in 2006

Online flight booking didn’t disrupt airlines much, but it was hugely disruptive to travel agents. Online booking was sustaining innovation for airlines and disruptive innovation for travel agents (as Clay Christensen would define it).

Meanwhile, the people who are first to bring the disruption to market may not be the people who end up benefiting from it, and indeed the people who win from the disruption may actually be doing something tangential - that is they may be in a different part of the value chain.

Apple pioneered PCs but lost the PC market, and the big winners were not even other PC makers. Rather, most of the profits went to Microsoft and Intel.

PCs themselves became a low-margin commodity with fierce competition, but PC CPUs and operating systems (and productivity software) turned out to have a very strong winner-takes-all effects.

Being first is not the same as having a sustainable competitive advantage, no matter how disruptive you are, and the advantage might be somewhere else anyway.

This gives us four things to think about when looking at Tesla:

✅ First, it does have to learn the ‘old’ things - it has to learn how to make cars at scale with the efficiency and quality that the existing car industry takes for granted, preferably not in a tent, and preferably without running out of cash on the way. But, solving ‘production hell’ is just a condition of entry - it’s not victory. If it can only do this, it’s just another car company, and that’s not what has anyone excited. It’s what the cars are that matters.

✅ Second, Tesla also has to be doing new things that the incumbent car original equipment manufacturers (OEMs) will struggle to learn. This is not quite the same as doing things that the OEMs’ suppliers will struggle to learn.

✅ Third, those disruptive things need to be fundamentally important - they need to be enough to change the basis of competition, and to change what it is to be a car and a car company, so that it matters if they can’t be copied.

✅ Fourth, in addition to all of these there needs to be some fundamental competitive advantage, not just over the existing car industry but also over other new entrants. Apple did things Nokia could not do, but it also does things that Google cannot do.

Now, let’s talk about what’s happening in cars. This is complex, because there are several somewhat separate changes happening at the same time.

First, batteries and motors

Tesla has catalysed the realization that lithium batteries let us make electric cars that are as good as internal combustion engine (ICE) cars, and that if we can get the battery volumes high enough, these cars can eventually be as cheap as ICE cars.

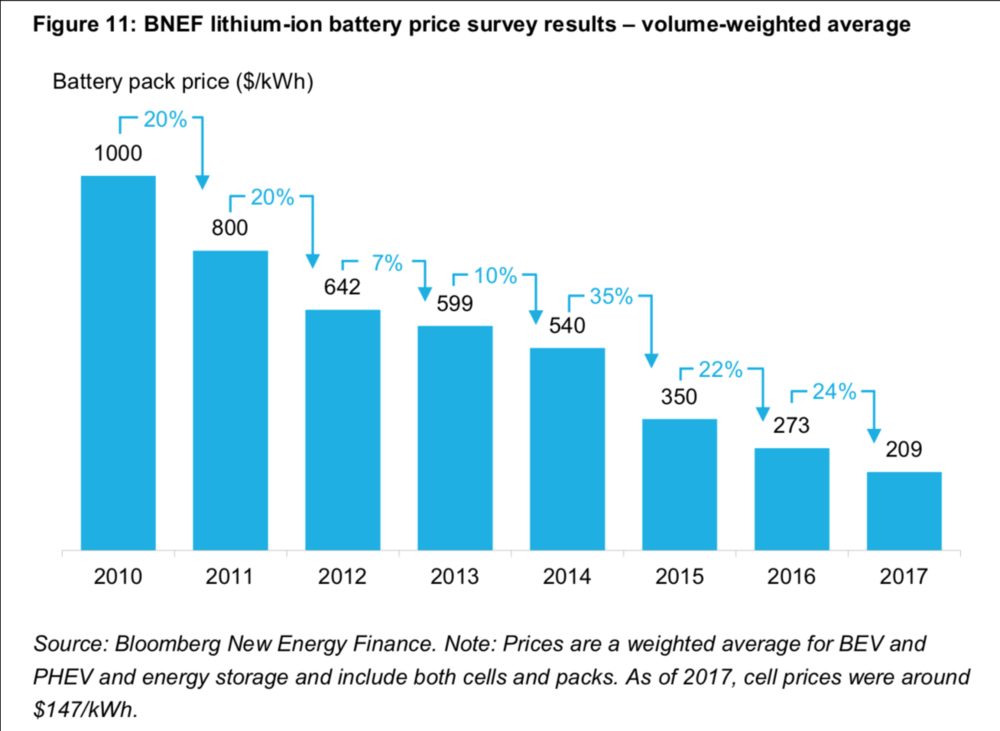

The chart below shows the result. Batteries need to get to perhaps 100 $/kWh on this scale to be cost-competitive with gasoline - we're almost there.

Many car industry insiders would say that Tesla has a lead of several years in the engineering and implementation of this.

However, lithium batteries and electric motors are not an exotic new technology with lots of primary IP. Nor are there any network effects or ‘winner takes all’ effects.

Deterministically, it seems pretty likely that in the medium term (that is, by the time batteries are cheap enough for wholesale conversion of the industry from ICE to electric) both the batteries themselves and the motors and control systems will be mostly commodities.

That does not mean there will not still be plenty of science and engineering to them, but rather that, just as happened to components for smartphones, the entire global electronics industry will be competing to make the best parts, and will sell them to whoever wants to buy.

In such an environment, creating great components in-house does not necessarily give you any particular advantage any further up the stack.

Sony’s image sensor unit is doing very well in the smartphone business, but Sony’s smartphone unit is not doing well at all.

Conversely, Apple rigorously manages close to 200 suppliers (including Sony) and designs only a small number of critically differentiated parts itself (for example, the FaceID sensor).

Hence, industry insiders have opinions about who makes the best power amp or GPU, but this is mostly invisible to consumers, except in the aggregate of the choices made by the OEM.

So, Tesla will have its battery factories (in partnership with Panasonic), and be one of the biggest suppliers, but in a decade that will be (on one estimate) perhaps 15% of global EV battery production.

On one hand, that’s impressive for a new entrant, but on the other, it illustrates the fact that batteries will probably give only a limited competitive advantage. Everyone will have batteries.

In this chart, grey is 2017, orange is 2023 and yellow is 2028

It’s probably useful here to compare batteries in particular with the capacitive multi-touch screens in a smartphone.

Apple was the first to popularise these screens, and arguably still implements them best, and these screens fundamentally changed how you made a phone, but the whole industry adopted them.

There are better and worse versions, but everyone can buy these screens now, and making a multitouch phone by itself is not a competitive advantage.

Meanwhile, electric is not just about replacing the fuel tank with a battery.

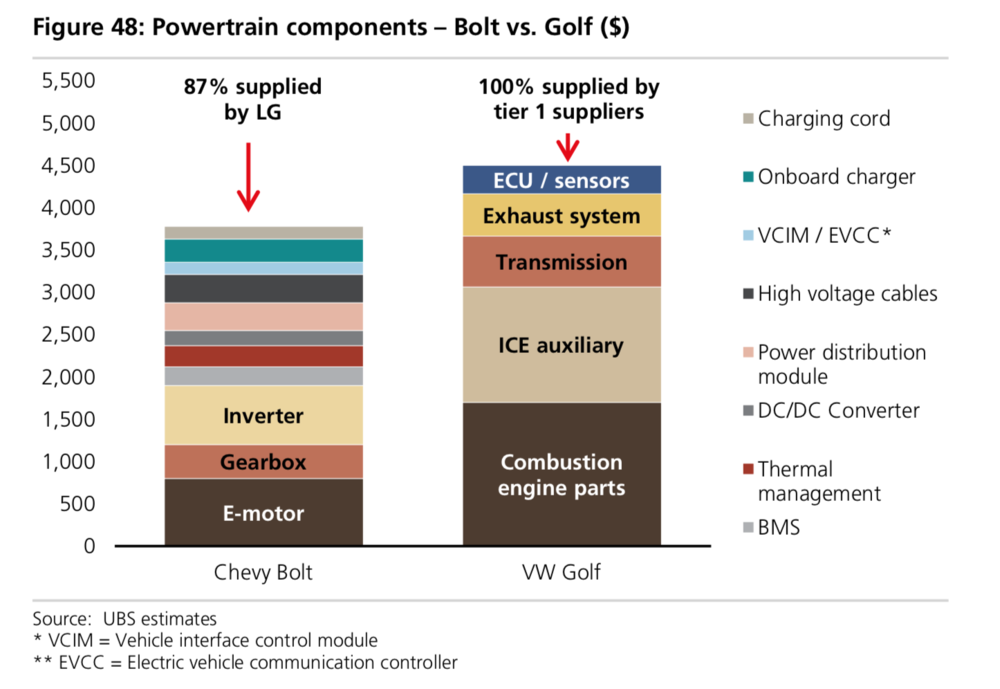

Electric disrupts the internal combustion engine and everything associated with it - you remove the whole drive train and replace it with something with 5 to 10 times fewer moving or breakable parts. You rip the spine out of the car.

This is very disruptive to anyone in the engine business - it disrupts machine tools, and many of the suppliers of these components to the OEMs. A lot of the supplier base will change.

This is not the same as disrupting the OEMs themselves.

If the OEMs can buy the components of an electric car as easily as anyone else, then the advantage in efficient scale manufacturing goes to the people who already have a lead in efficient scale manufacturing, since they’re doing essentially the same thing.

In other words, it’s the same business, with some different suppliers, and electric per se looks a lot more like sustaining innovation.

Second, software, modularity and integration

If the components will be a commodity, integrating them may not be - at least, not necessarily.

First, the integration of the electric drive train components themselves is not trivial, and doing it better can get you more efficiencies.

This is one of the places where Tesla probably has an engineering lead, today.

What’s not clear is how big that lead will be in (say) five years, and quite what competitive advantage it gives. If, for the sake of argument, Tesla has a 10% or 20% advantage on range at a given price, this matters for a touring sedan, but does it also matter for a minivan doing the school run, that drives 10 miles a day and parks in a garage with a charging point every night?

How much of a competitive advantage will that be in 10 years, compared to all the other factors that people use to choose a car? Is this a margin advantage, a competitive advantage, or just a checkbox to be compared with other features? We’ll see.

This integration question is actually much broader than just the drive train. There’s an old car industry joke that you can see the organization chart of a car company in the dashboard, and also see that the steering wheel team hates the gear stick team.

A modern car has dozens of different electrical and electronic systems, and these are mostly separate and independent. The ABS has nothing to do with the blind spot detection.

All of these systems are bought by different teams at the OEM from different suppliers, and the only point of integration is the switches on the dashboard.

Each of these components has what the car industry calls ’software’ (“millions of lines of code!”), but this is really what Silicon Valley would call firmware, or at most 'device drivers' also, unlike Silicon Valley products, these systems are expected to last for ten years and 150k miles).

Much of this is probably going to change. We will go from complex cars with simple software to simple cars with complex software.

Instead of many stand-alone embedded systems each doing one thing, we’ll have cheap dumb sensors and actuators controlled by software on a single central control board, running some sort of operating system, with many different threads (there are a few candidates). This is partly driven by electric, but becomes essential for autonomy.

This is clearly a challenge to the suppliers who make those separate systems, and there are also plenty of reasons why this might be hard for an incumbent car company to adapt to (most obviously, that org chart).

This is also exactly the sort of thing that non-tech companies tend to think will be easy (‘we’ll just hire some developers!’), and instead make into a horrible mess, and they may have to go through a cycle of learning that they don’t do it well themselves before buying it from someone who does it better.

That is, this looks a lot more like disruption than electric itself does. Tesla is of course already here, which is why it could fix a brake problem in the Model 3 over the air - the code it needed to change wasn’t in the brakes.

The question again, though, is quite what this means in the market for cars as opposed to the market for car components.

There’s a useful parallel here with PCs and laptops. Apple is very specific in what components it uses and how they are optimized to work together and fit into the available space, and this produces small, light, power-efficient laptops.

Conversely, a laptop from Dell, or a desktop PC, has much more flexibility and interchangeability of parts, which also means less integration and more empty space inside the case.

Each approach has its benefits, and the modular PC model had perfect product-market fit in the 1990s. So, how far does this translate into reasons to buy?

Third, Tesla’s ‘experience’ disruption

The obvious place to answer this question comes when you turn on the car, and this also takes us to the other parts of what makes owning a Tesla better, today.

So far, we have been talking about the electric drivetrain itself - the ‘skateboard’. It seems more likely that this disrupts the OEMs’ supply chain than the OEMs themselves.

However, there is a whole other class of aspects of a Tesla that are different, both inside the car and in things like the dealer experience. How do we think about these?

The easiest place to see disruption from Tesla is in the dashboard of the Model 3.

There are reasons discussed above why it will be organizationally difficult for a car company to put absolutely everything onto one screen. But the deeper reasons might just be how much they want to do it.

The Model 3 dashboard is partly about cost saving (fewer widgets to install), but this is also a rejection of a huge number of deeply embedded beliefs about what a car should be. This is not how car people think. Car UIs today feel little like feature phones in 2006, as I wrote here last year.

There are other cool things that come from the de novo model. Outside the car itself, Tesla can sell direct on a fixed price instead of going through dealers.

OEM dealers often have contracts around who can install new software (so no remote updates allowed) and those dealers make most of their profits from repairs.

Around half of repair spending is on things directly linked to the ICE - no ICE means no oil leaks or broken fan belts. Dealers also play an important role in setting pricing and incentives, and driving demand to specific models.

These are all more things that are hard for the incumbent industry to adapt to.

However, again, it’s unclear to me how central these things are. The counter-argument, perhaps, is that that this is comparable to things like the Apple Stores, or the on-device activation of your phone account when you buy an iPhone.

These are nice, and a selling point, and hard for Samsung to match, but do we think Apple’s market share would collapse without them?

This is of course very subjective (“how much does this cool thing matter?”), so here’s a thought experiment: if these factors were the only difference between a Tesla and a BMW or Mercedes, and the drive train, acceleration etc were all identical, would they be enough?

If BMW suddenly started selling direct and doing seamless OTA firmware updates, would Tesla’s share price collapse? Probably not.

Less subjectively, it’s not clear there will be winner takes all effects here. There might be a developer ecosystem on the car itself, but it’s just as likely that the proper place for apps in your car is on your phone, or in the cloud. Certainly, it’s too early to be sure.

Finally, as really should be obvious, there will be chargers everywhere. Once the actual motivation is there, all sorts of companies will build charging stations everywhere they can. The only barrier is capital - there’s no competitive moat here.

Fourth, autonomy

All of this takes us to autonomy. Electric is compelling but will probably be a commodity, whereas Tesla’s improvements on top of electric may not be commodities but are not necessarily decisive. Autonomy changes the world in profound ways (I wrote about this here), and it’s a fundamentally new technology that doesn’t look at all like a commodity. And Tesla is doing this, too. Sort of.

In most of the previous conversation, I talked about how Tesla as a technology company would or would not disrupt non-tech companies. However, in autonomy, Tesla is not just competing with car companies - it’s competing with other software companies. It doesn’t have to beat Detroit at software - it has to beat all the rest of Silicon Valley at software.

In this competition, Tesla’s thesis is that the data it can collect from its cars will give it a crucial advantage.

The only reason that anyone is interested in autonomy today is that the emergence of machine learning (ML) in the last 5 years probably gives us a way to make it work.

Machine learning, in turn, is about extracting patterns from large amounts of data, and then matching things against those patterns. So how much data do you have?

Hence, Tesla’s approach to autonomy has been to put as many sensors as possible into the cars it’s already selling, and collect as much data as possible from those sensors. It can do this because its cars are already built on a software platform (as discussed above) - it can ‘just’ add the sensors, in ways that the existing OEMs cannot yet do.

Then, as it gets more and more levels of autonomy working, it can push that out over the air (OTA) to the cars as software updates. Since it already has so many cars with these sensors on the road, this will have a self-reinforcing ‘winner takes all’ effect: it will have more data, and so its autonomy will be better, and so it will sell more cars, get more self-driven miles and so have more data.

If this pays off, it would indeed be a profound and compelling competitive advantage for Tesla, even without thinking about all the other possibilities, such as renting your Tesla out as an autonomous taxi.

However, this is just a thesis, and there are two basic questions underlying it: can we do autonomy with vision, and what winner takes all effects apply?

First, vision. The really obvious problem with Tesla’s autonomy plan is that today ‘as many sensors as possible’ means that Tesla is using cameras placed around the car to give a 360 degree view, plus radar that is only forward-facing (and some short-range ultrasonics). This means it must rely on vision alone to get a full 360 degree 3D model of the world around the car.

Unfortunately, computer vision is not yet able to do this well enough.

Most people in the field would agree that this will be possible at some point (after all, humans don’t have LIDAR), but it’s not possible yet.

Moreover, this isn’t a question of just adding more data and getting vision to work by brute force (or at least, we don’t know that it is). This is why pretty much everyone else is using vision combined with multiple LIDAR sensors and often multiple radar units as well.

Today, that adds tens of thousands of dollars of cost to each vehicle. If you’re only running an engineering testing and development fleet of at most a few dozen or hundred vehicles, this is bearable, but it’s clearly not possible to add this to every new Tesla Model 3 - the sensors would cost more than the car. (There’s also the issue that you have to add bulky, fragile and impractical lumps all over the car.)

The cost and size of these sensors is falling fast (for example, there is a race to get the first solid-state LIDAR working), but we are still some years away from their being cheap enough to put on a production car.

But meanwhile, even if you do have a sensor suite and ‘sensor fusion’ that can create an accurate 3D model of the world around the car, the rest of the autonomous puzzle isn’t working yet for anyone, nor does anyone in the field think that this is close. Bits of it work quite well - cruise control on highways, say - but the whole does not.

Hence, Tesla’s first bet is that it will solve the problem of building a model of your surroundings using only vision before the other sensors get small and cheap, and that it will solve all the rest of the autonomy problems by then as well. This is strongly counter-consensus.

It hopes to succeed taking the harder way before anyone else does it the easier way. That is, it’s entirely possible that Waymo (formerly the Google self-driving car project), or someone else, gets autonomy to work in 202x with a $1,000 or $2,000 LIDAR and vision sensor suite and Tesla still doesn’t have it working with vision alone.

The second bet is that Tesla will be able to get autonomy working with enough of a lead to benefit from a strong winner-takes-all effect - ‘more cars means more data means better autonomy means more cars’. After all, even if Tesla did get the vision-only approach working, it doesn’t necessarily follow that no-one else would. Hence, the bet is that autonomous capability will not be a commodity.

This takes us back to the data. Tesla clearly has an asset in the data it can collect from the 200k+ Autopilot 2 cars it’s already sold. On the other hand, Waymo’s cars have driven 8m miles, doubling in the last year or so. Tesla’s have driven more (without LIDAR, but set that aside), but how much do you need?

This is really a question about all machine learning projects: at what point are there diminishing returns as you add more data, and how many people can get that amount of data?

It does seem as though there should be a ceiling for autonomy - if a car can drive in Naples for a year without ever getting confused, how much more is there to improve?

At some point you’re effectively finished. So, how many cars gathering data do you need before your autonomy is as good as the best on the market? How many companies might be able to reach that? I

s this 100 or a thousand cars driving for a year, or 1 million cars? And meanwhile, machine learning itself is changing quickly - one cannot rule out the possibility that the amount of data you need might shrink dramatically.

So: it’s possible that Tesla gets the vision-only approach to work, and gets the rest of autonomy working as well, and its data and its fleet makes it hard for anyone else to catch up for years.

But it’s also possible that Waymo gets this working and decides to sell it to everyone. It’s possible that by the time this starts to go mainstream, 5 or 10 companies get it working, and autonomy looks more like ABS than it looks like x86 or Windows. It’s possible that Elon Musk’s assertion that it should work with vision alone is correct, and 10 other companies then get it working.

All of these are possible, but, to repeat, this answer is not a question of disruption, and this is not a matter of whether software people will beat non-software people - these are all software people.

This post began as a much shorter piece about Tesla and Netflix, comparing two companies that are using software to change other industries. But the fascinating thing about Tesla is that there are so many different things going on, and so many different kinds of innovation. I’m sure I’ve missed plenty of things. One of the issues that recurs in thinking about Tesla is that tech people don’t really know enough about cars, and car people don’t really know enough about software.

But the history of the tech industry is full of companies where having a lovely product, or being the first to see or build the future, were not enough. Indeed, the car industry is the same - a great, innovative car and a great car company are not the same thing. Tesla owners love their cars.

I loved my Palm V, and my Nokia Lumia, and my father loved his Saab 9000. But being first isn’t enough and having a great product isn’t enough - you have to try to think about how this fits into all the broader systems.